Petrol station, gas station, filling station, garage forecourt – call it what you will. The place where we put fuel into our vehicles is changing.

BP recently said only half of purchases at its forecourts across the UK were for fuel. The other half was for food.

Alongside that changing consumer habit, and perhaps driving it, we have the rapid growth in the EV market. People in EVs can’t just drive up, fill up, pay up and leave, all in the space of five minutes. They need time to let the batteries charge.

And then in the world of payments, we’ve seen huge developments from the old magnetic strip on physical cards to paying with just a wave of a phone or watch. Indeed, digital wallets are fast becoming the most popular way of paying.

“Nothing stays the same for ever. But what is constant is a need for customers to pay in as frictionless a way as possible,” says Russell Green, Head of Emerging Verticals at Elavon Europe and an expert on payments in the mass-transit industry.

“Consumers want to be able to pay their way, whether that’s cash, card, in-app or with a digital wallet. That’s why we asked what their preferred way to pay for fuel. Our research helps you inform what you offer.”

We commissioned Yonder to survey more than 2,000 adults in the UK to find out their preferred way to pay for fuel.

The majority (88%) of adults who pay for fuel, said they like to pay by card, that’s either a physical credit or debit card, a digital wallet, or in-app. Only 1% of the population use a corporate fuel card.

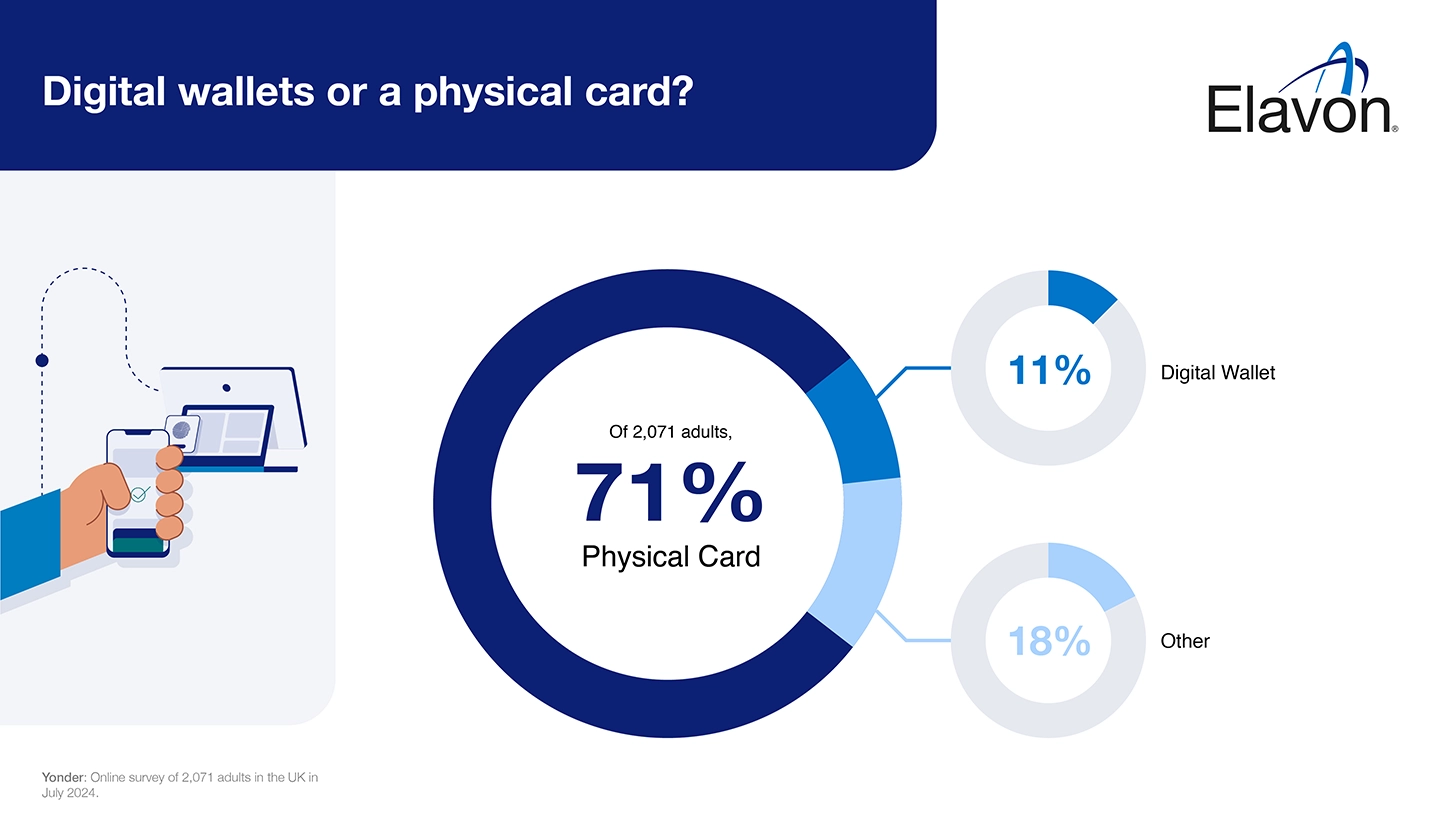

Pay with a digital wallet or a physical card

When paying by card, plastic remains the most popular form of payment, either at the pump or in store.

Out of those who drive, 71% said they would rather use their credit or debit card compared with 11% who opt for a digital wallet. The rest either don’t know, use a corporate card, pay in-app or pay by cash

“This could be down to people thinking that the contactless limit used for cards, also applies to mobile devices,” says Russell.

“When paying for fuel, often a larger purchase, people are instinctively reaching for their wallets, when they could just tap their phone or watch.

“It’s worth reminding your staff that the limit is far higher than the £100 of a contactless card so customers aren’t unnecessarily put off using their phone.

“As well as the convenience, digital wallets also bring extra security for your business and your customer.”

A closer look at the data shows that younger people are much more likely to use a digital wallet to pay than older, suggesting a growth in this area.

More than a quarter (28%) of adults under 25 pay with a digital wallet compared with less than a fifth (18%) of 25-34 year olds. Only about 5% of the over 45s use a digital wallet to pay for fuel.

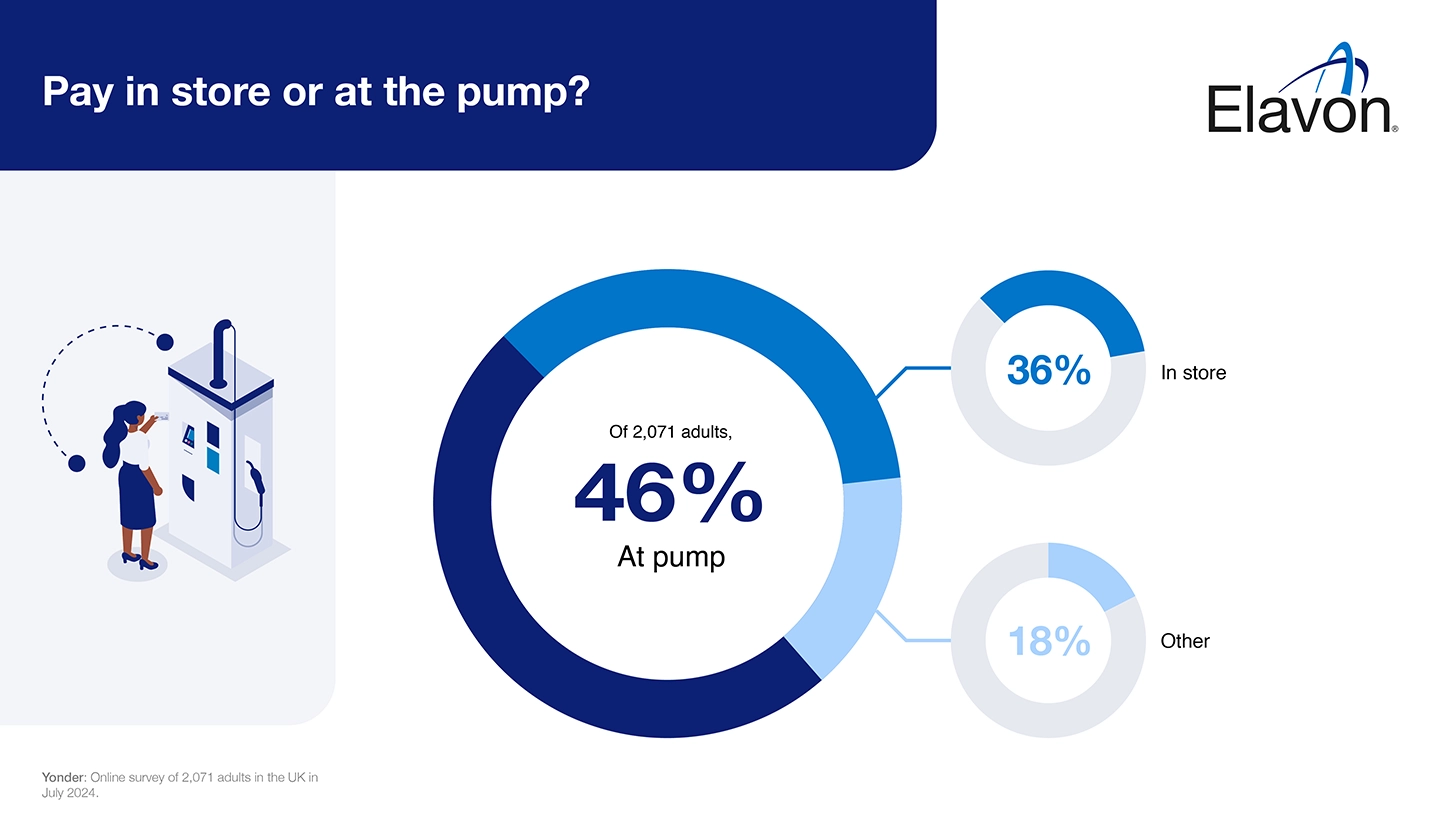

Pay at pump or pay in store?

As well as asking people how they preferred to pay, we wanted to know where they wanted to pay.

Almost half (46%) want to pay at the pump with a little over one in three (36%) wanting to pay in store.

“There’s a preference for paying for fuel at a pump. Here you’re offering speed and convenience so well worth considering if you’re in a high traffic zone or if you’re short of space in-store,” says Russell.

“But with a third of drivers still wanting to pay in-store you’ve got a chance to diversify, selling coffee and snacks for the road, or even a more substantial grocery offering,” says Russell.

“You might want to offer both options, making even more of your customers happy.”

Only a small minority, just 4%, of drivers in Ireland want to pay with an app.

What are unattended payments?

Unattended payments does exactly what it says on the tin – a transaction that takes place between a customer and a merchant without an assistant or cashier. Think fast food restaurants, parking meters or drinks vending machines.

For businesses, it lowers costs, increases speed and helps them reach more customers.

Customers enjoy the speed and convenience, shorter queues and being able to pay 24 hours a day.

Unattended payments can be that sweet spot where business’ preferences and their customers’ preferences perfectly align.

If you’re interested in unattended payments, you need to make sure you have an expert partner to make sure they are safe and secure for you and your customers.

Is cash still relevant?

The rise of the card might seem inevitable, but we still see one in ten (11%) of drivers in the UK wanting to use cash.

Interestingly, the over 65s are the least likely (8%) age group to want to pay cash, followed by the 25-34 year olds at 10%.

There is a slight geographical variation as well. Almost a quarter (22%) of drivers in Northern Ireland like to pay cash with Scotland and the North West of England at 15%. That compares with just 8% in the East Midlands and 9% in London and the South East.

"Connectivity in some rural areas can be an issue for unattended payments," said Russell Green. "It's possible that cash remains more embedded in those areas because card connectivity can be patchy or payments can take too long to process when people are in a hurry.

“As mobile data connectivity improves, so too will payments.”

So while the landscape of fuel forecourts is shifting, understanding how consumers want to pay can set you ahead of the crowd.

You need a payments partner that understands those preferences and has the knowledge and technology to offer a choice to your customer so they can pay the way they want.

Talk to us to find out more.

Source: Yonder conducted an online sample of 2,070 UK adults 18+ between 5 - 7 July 2024. Data is weighted to be representative of the population of the UK. Targets for quotas and weights are taken from the PAMCO survey, a random probability survey conducted annually with 35,000 adults. Yonder is a founding member of the British Polling Council and abides by its rules.

Question: Which of the following, if any, is your preferred payment method when refilling/ charging your car? Table rebased to exclude those who don’t pay for fuel.

|

Base |

1641 |

|---|---|

|

Pay by cash |

11% |

|

Pay with a debit or credit card either by tapping or chip and pin at the pump |

41% |

|

Pay at a kiosk/in-store with a physical credit or debit card |

29% |

|

Pay in-app |

3% |

|

Pay with a smartphone/ smartwatch at the pump |

4% |

|

Pay with a smartphone/ smartwatch in-store or at a kiosk |

7% |

|

Pay with a corporate fuel card |

1% |

|

Don't know |

4% |

Base

1641

Pay by cash

11%

Pay with a debit or credit card either by tapping or chip and pin at the pump

41%

Pay at a kiosk/in-store with a physical credit or debit card

29%

Pay in-app

3%

Pay with a smartphone/ smartwatch at the pump

4%

Pay with a smartphone/ smartwatch in-store or at a kiosk

7%

Pay with a corporate fuel card

1%

Don't know

4%