Foreword

The hospitality industry has been through a turbulent few years. The global pandemic hit hotels, restaurants, pubs and other venues hard, while the subsequent inflation and cost-of-living crisis created a collective sucker-punch that left millions of businesses out for the count. Keeping venues open during lockdown was a significant challenge, but convincing customers to return in its wake proved just as difficult. Owners found themselves with mountains to climb in order to rebuild trust and confidence.

Fortunately, in 2023, there are signs of recovery. While health and safety remains a concern, data suggests that customers are coming back to hotels, bars and restaurants – albeit with new habits and service preferences. However, while the industry may have passed through the eye of the storm, new challenges are emerging and hospitality businesses must be prepared to deal with them in order to maintain recovery momentum.

As an industry, it’s up to us to study and understand these new trends and patterns, and to adapt to give customers the kind of experiences they want – and would want to return to in the future. There’s no magic bullet for understanding these emerging trends: customer preferences vary by sector, location and sub-sector, along with a spectrum of micro-factors that influence decision making. This means that businesses must take initiative to determine which trends are relevant to them, how they apply and what they’ll need to do to capitalise on them moving forward.

Given the importance of maintaining industry growth, Elavon has conducted research with a range of UK hospitality stakeholders and industry experts, incorporating secondary data to support our insights. We have used what we learned to build a picture of the industry landscape in 2023 and beyond, and to highlight both the challenges that businesses face (and will face) and the payments strategies they can implement in order to boost their recovery efforts and continue to increase revenue.

David Wheatcroft, head of hospitality, Elavon Europe

After a turbulent few years, the hospitality industry is showing signs of recovery – but new challenges are on the horizon.

Healthy eating, technology innovations, global travel and on-demand culture are reshaping the post-pandemic hospitality landscape.

While customers are returning to bars, restaurants and hotels, their habits, demographics and service expectations have changed.

Understanding emerging customer trends, preferences and behaviour patterns will be critical to hospitality business’ recovery hopes.

Every business is different: owners should be prepared to unlock the potential of their payment systems to maintain recovery momentum.

Elavon’s in-depth research into the hospitality industry in 2023 is a chance for businesses to capitalise on opportunities and chart a path to growth.

Executive summary

Our research spanned a range of primary and secondary sources, and included interviews, statistical data and surveys. Our primary research involved interviews with Elavon stakeholders, including hospitality experts in business development, sales, partner development, strategy and relationship management. Our secondary research focused on the recent market performance of key sub-verticals in the hospitality industry and drew data from Statistica and Technavio.

To support our primary and secondary research, we conducted four interviews with external industry experts working in large corporate hospitality businesses, and as operational efficiency advisors to mid-to-large corporate hospitality businesses. We also conducted a short survey with Elavon customers.

This paper will use our research to explore the state of the hospitality industry in the wake of the global pandemic, and in the midst of rising prices and a cost-of-living crisis. The paper will set out a range of macro trends affecting the hospitality industry in 2023, with projections for how those trends will continue to have an effect in the future. It will examine the trends on key industry sub-sectors, with a special focus on payments-relevant insights and data.

Following the sectoral trend analysis, the paper will highlight key payments opportunities for businesses as they continue to drive post-pandemic recovery and seek out new ways to boost revenue streams. It will also spotlight a range of upcoming payments technologies to support those efforts, with new tools that address specific hospitality tasks and challenges.

The following content should be seen as a hypothesis rather than fully validated insight.

Macro trends affecting hospitality

Market growth following the Covid pandemic

The Covid pandemic was the single greatest threat to the hospitality industry in living memory, and affected businesses in every part of the world. In 2020, the UK hospitality industry saw revenue drop by 54%, amounting to a loss of around £72 billion, while the industry’s workforce fell from 3.2 million to less than two million employees by the start of 2021.1

Fortunately, many hospitality businesses proved resilient in the aftermath of pandemic lockdown restrictions – a characteristic that fuelled recovery in 2022 and beyond. Studies suggest that the average UK hotel occupancy rose to around 80% by June 2022, up 57% from 2021.2 This was accompanied by increased investment in the industry, with over 30,000 new rooms added since 2020, and around 18,500 new rooms scheduled to open by the end of 2025.3

While moving at a slower pace than their hotel counterparts, UK bars and restaurants are also building momentum, with regional businesses benefitting from consistent growth since the first half of 2022.4 In 2023, industry analysis revealed that the UK’s top 100 restaurants had made a collective profit of £241.8 million between October 2021 and March 2022, twelve times the amount generated in the previous six months.5 Market research suggests that the UK’s eating-out market will grow by 4.6% in 2023, with profits boosted by an expected increase in consumer spending as the cost-of-living crisis eases.6

While there are many reasons to be optimistic about the future of the hospitality industry, the shoots of recovery remain fragile in the context of the wider economy. However, industry caution should not come at the expense of seizing opportunities, such as embracing new payments innovations and technologies as a way to supercharge revenue.

With that in mind, Elavon’s research into hospitality industry trends has revealed several key factors that will affect businesses in the coming months and years.

Economic trends

Two macro trends are impacting the operations and economics of the hospitality industry.

1) Staffing shortages: in the aftermath of the pandemic, restaurants and hotels have faced difficulties hiring staff.

The hospitality job vacancy rate stands at 11%, compared to the average UK-wide vacancy rate of 4%. The shortfall is costing the industry around £22 billion per year.7

Up to 84% of restaurants in the UK are struggling to recruit personnel,8 with many offering pay rises in an attempt to retain existing employees.

2) Persistent inflation: high levels of inflation in both the UK and the EU are impacting costs in the hospitality industry and demand for services.

77% of hospitality operators have reported a drop in the numbers of people eating and drinking out..9

Fresh food prices increased by 15% in December 2022, representing the highest monthly increase since 2005.10

59% of Brits planning overseas holidays in 2023 said they expected economic volatility to impact their plans.11

Consumer trends

Driven by emerging societal influences, two major consumer trends are also impacting hospitality industry purchase behaviours:

1) Healthier choices: consumers have expressed a desire to make healthier food and beverage choices.

58% of UK consumers have reported greater interest in eating healthily than they did a decade ago.12

A 42% increase in online searches with the word ‘mocktail’ suggests that consumers are looking for ways to decrease their alcohol consumption without sacrificing social experience.13

2) Higher experience expectations: modern consumers have higher expectations of the brands and companies that they use.

88% of customer service teams report that customers have higher expectations than ever before.14

75% of consumers will stop using a particular brand following three or fewer, negative experiences.15

Sub-sector trends

A broad perspective on the hospitality industry is useful, but businesses can often gather more meaningful insight by examining trends that apply directly to their sub-sectors. The hospitality industry has two main categories: accommodation and food and beverage businesses. While these categories are both typically split into subcategories, our research focuses on the accommodation subcategories of hotels, seated dining, quick service and pubs, bars and clubs.

Hotels

Global travel:

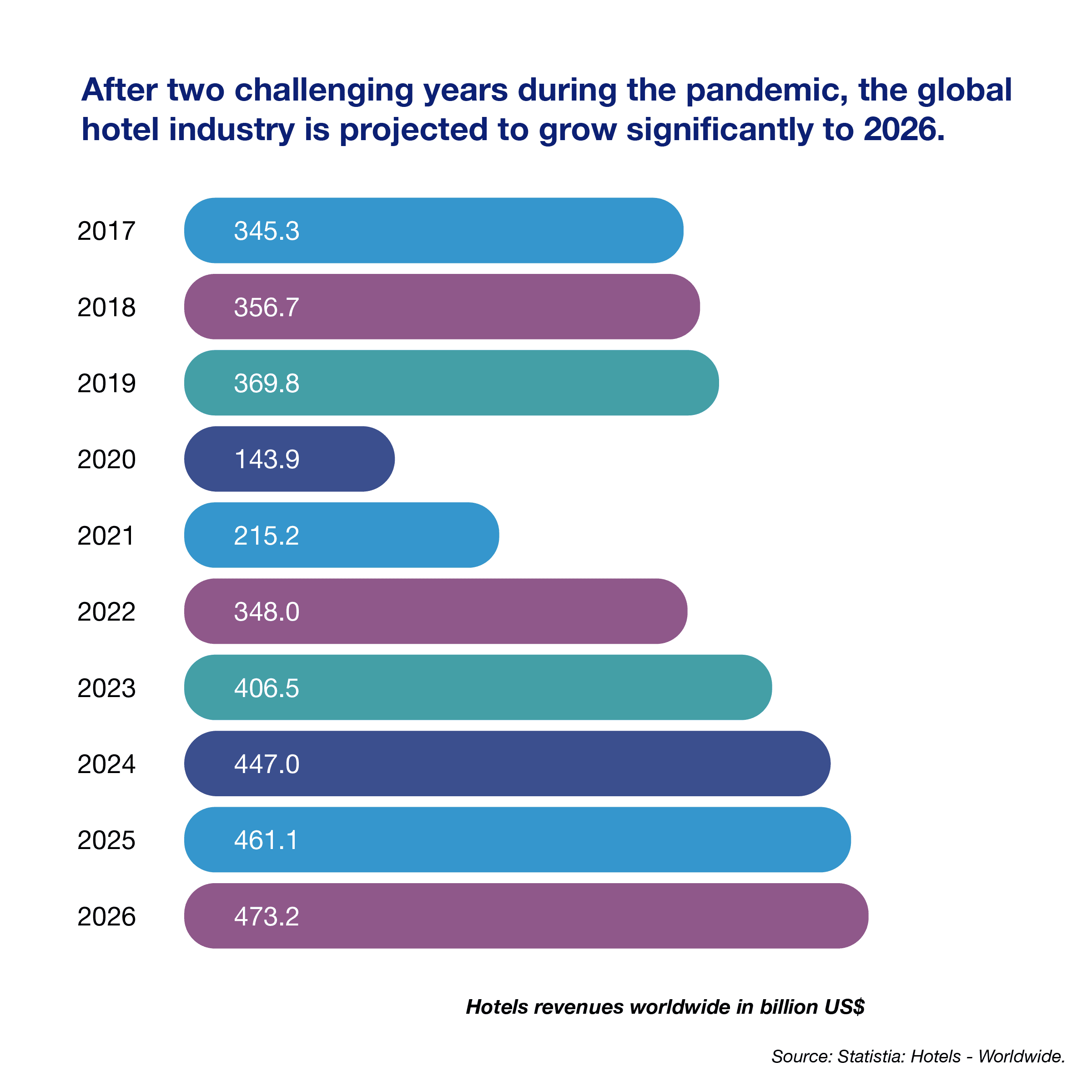

Following the Covid pandemic drop, the global hotel industry is projected to grow significantly into 2026, with an increase in revenue of almost $70 billion from 2023.16 These global figures suggest that hotels in Europe, the US and China will drive the market’s growth, with higher hotel prices and an increase in travellers from emerging economies offsetting any shortfall from a decline in middle-income travellers.

Online bookings:

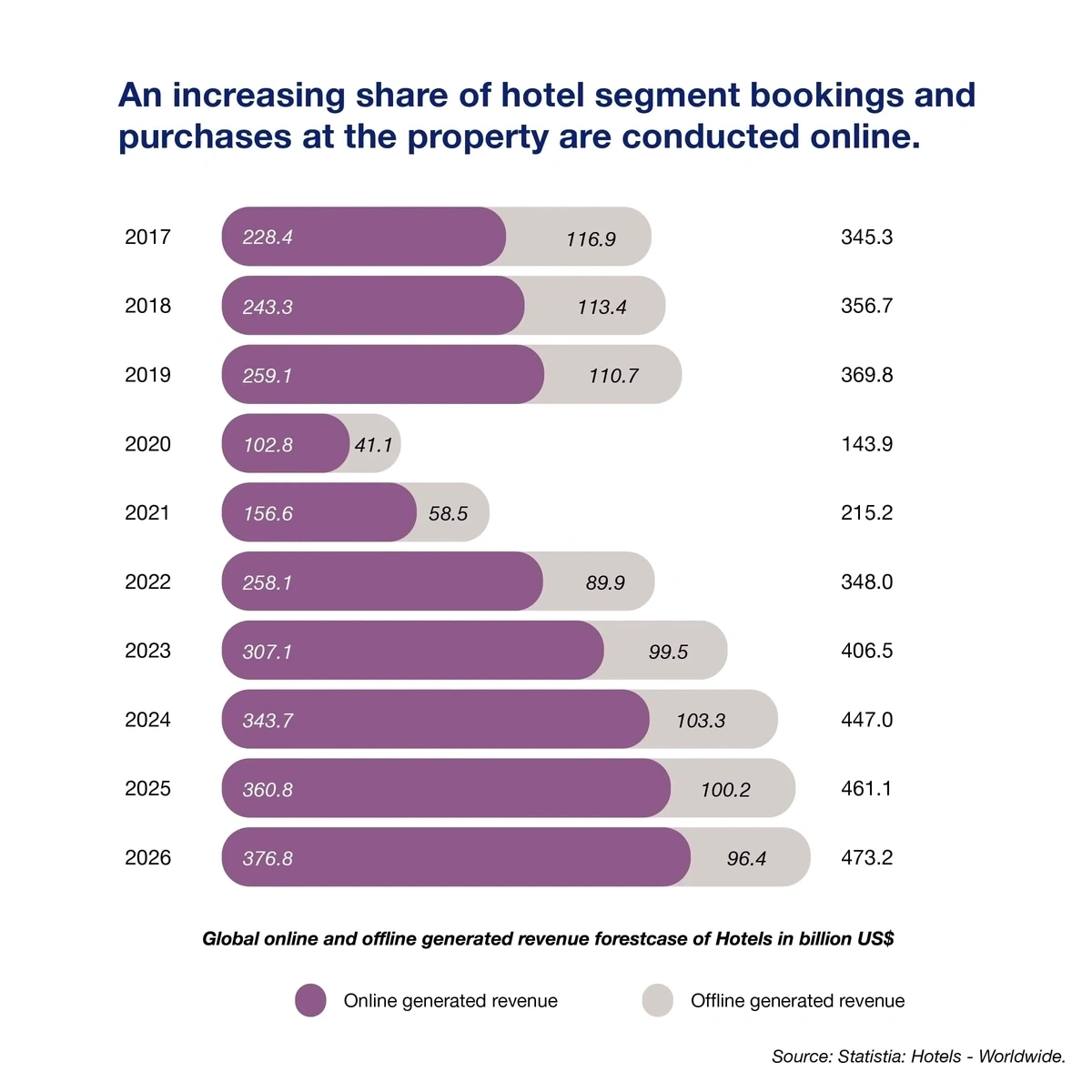

An increasing proportion of hotel bookings and purchases are made online. In 2023, for example, global hotel revenue is estimated to reach $406.5 billion, with $307.1 billion of that amount generated online.17 By 2026, that amount is projected to reach $473.2 billion, with $376.8 billion generated online – representing 90% of all revenue. Our research revealed that a key driver of the revenue growth is integration across the hotel property, reducing opportunities for customers to pay directly by card.

UK leading:

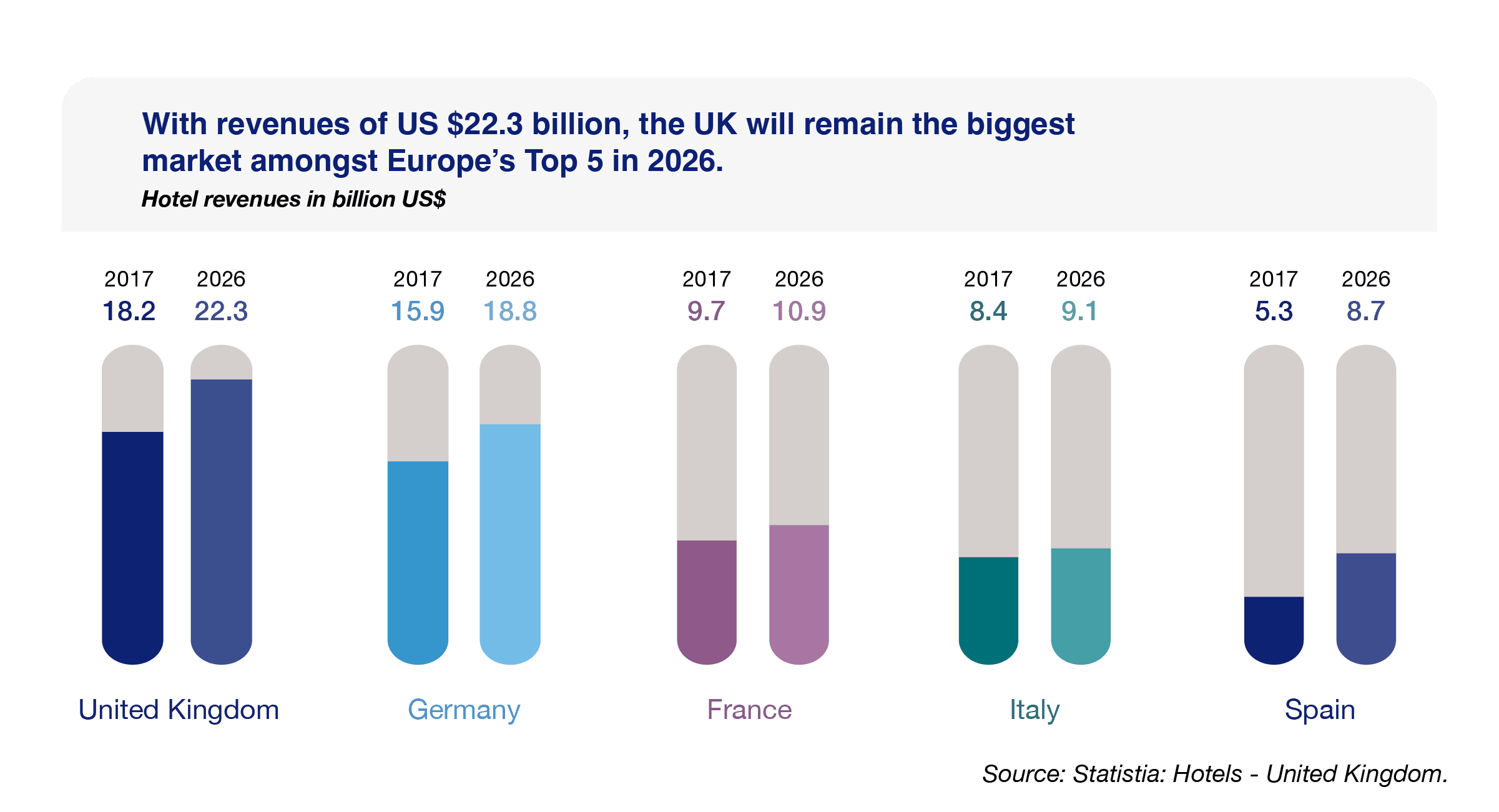

The revenue projections for 2026 place the UK as the largest market in Europe, ahead of Germany, France, Italy and Spain. The UK’s hotel industry is expected to generate $22.3 billion in revenue in 2026 (an increase of 22% from 2017), followed by Germany with $18.8 billion.18

The strength of the UK market is based on three factors:

An increase in domestic UK travellers using hotels for business and leisure.

An increasing number of international customers. In 2023, the number of international customers rose to 86% of its 2019 level.19

An overall increase in the price of hotel services.

Germany remains an attractive market for hotels. However, since it has more overall hotel users (37.96 million), and lower average room prices, Germany’s hotel stays result in a lower average per user spend.20

Spending increase:

The research suggests that average hotel spending will increase significantly by 2026.21 The UK will again lead the European market, with the average hotel user spending $628.1 in 2026 – compared to $559 in 2017 (representing a 12% rise).22 Beyond the UK, the four highest markets for higher hotel spends are Denmark, Norway, Belgium and Switzerland.

Our research suggests that a combination of higher hotel prices and an increased overall number of hotel stays are driving the increased spending trend.

Key hotel payment trends

Several key trends are impacting payments in the hotel industry:

Online spend: by 2026, online spend will represent 80% of total hotel revenue. This means that, going forward, payment integration with hotels’ primary websites will be key to increased revenue.

Personalisation: travellers increasingly expect personalised travel experiences. Hotels should seek to leverage software tools to increase the personalisation of guest stays – and explore the potential to extend those experiences into payments.

Higher prices: European hotel prices are increasing in line with inflation. This is driving increased revenue, while promoting the growth of lower price-point hotels as customers trade down for affordability.

Direct bookings: by encouraging direct bookings, with perks such as discounted prices, inclusive meals and comfort quality, hotels can increase their profile with users and encourage repeat stays.

Currency conversion: as the number of international travellers continues to rise, hoteliers can improve customer experience and encourage direct bookings by enabling customers to pay in their home currency – without the exchange fees.

"The Sheraton Lake Como processes around 10,000 transactions per year, 70% of which are card based. This percentage is increasing year on year, with the growing convenience of card payments and guests having the option now to pay in their home currency, using Dynamic Currency Conversion."

Why choose Dynamic Currency Conversion (DCC)?

Better experiences: let customers pay in their own currency, reducing the chance of chargebacks.

No surprises: provide certainty on costs and help customers avoid additional charges.

Accessibility: offer DCC for payments in-store, online or by telephone.

Simplicity: no need for customers to work out foreign exchange rates – simply pay and go.

Seated dining

The seated-dining category includes the subcategories ‘fast casual’ and ‘full service’. Market share is split between corporate chains (56%) and independent establishments (44%).23

Slower growth: seated-dining restaurants are projected to grow more slowly than quick-service restaurants (QSR), pubs, bars and nightclubs. By 2026, seated dining will reach a market size of $114.1 billion – up from $107.2 billion in 2023.24 The sector is projected to have a 21% compound annual growth rate (CAGR) between 2021 and 2026, and experience incremental growth of $6.8 billion in the same period.

There are a number of important takeaways from these growth projections:

Europe was the third-largest seated-dining market in 2022 and will hold that position in 2027.

As eating out grows in popularity in Europe, demand for restaurants will also grow. The trend is being driven by demand for healthy, nutritious on-the-go food, with the UK, Germany, France and Spain among the key market contributors.

A multitude of factors are also contributing to the growth of the eating-out market, including increasing urbanisation, changing lifestyles and diets, and a growing global employee population with less time for home cooking.

Key seated-dining payment trends

The key payment trends affecting the seated dining market are:

Higher prices: with higher prices at restaurants across Europe, many customers are choosing to eat at home in order to save money – a trend that has the potential to impact the total number of meals out.

New technologies: while technology adoption rates were already high amongst QSR, seated-dining restaurants are now adopting technological tools at increased rates.

Digital marketing: mid-to-large corporate seated-dining restaurants are increasingly engaging customers via 'big tech' digital channels – which could potentially expand to include payment processing functionality as part of the booking or review process.

“We switched to Elavon because we wanted a payment provider that offered better customer care. It’s not just a point-of--sale system: I can focus on the design, hiring the best staff, marketing and finances, because I know that the payments side of things is taken care of.”

Reducing no-shows: we asked more than 1,000 UK adults what, if anything, would encourage them to honour a meal booking. While 58% of respondents said they would always honour a booking or cancel in advance, using digital channels to take a deposit, or send reminders, may help encourage customers to show up.

The rise of digital dining: which technology trends are here to stay?

Quick service

Four segments: quick-service restaurant revenue is split into the following four segments:

|

QSR type |

Revenue split |

|---|---|

|

Eat-in service |

50.65% |

|

Takeaway service |

24.05% |

|

Drive-through service |

20.87% |

|

Home-delivery service |

4.43% |

QSR type

Revenue split

Eat-in service

50.65%

Takeaway service

24.05%

Drive-through service

20.87%

Home-delivery service

4.43%

The estimated global QSR market share breaks down to around 65% corporate restaurants and 35% independent.

European growth: research suggests that QSRs in Europe will see strong growth in the coming years, with the market projected to reach a value of $92.5 billion by 2026 – from $80.9 billion in 2023.25 Between 2021 and 2026, the QSR market’s CAGR will be around 3.18%, representing an incremental growth of $4.7 billion.

Europe was the third-largest QSR market in 2021, and is projected to hold that status until 2026. Its 3.18% CAGR is slightly slower than the global 3.7%.

Rather than competing on price, European QSR vendors are broadening their menus to attract different customer demographics as a way to maintain steady growth. European QSRs are also focusing on improving access for customers, opening in better locations and adapting to changing customer trends by improving their home delivery and takeaway services.

The increasing demand for healthy and nutritious on-the-go food is driving QSR growth in Europe, with the UK, Germany, France and Spain among the region’s key markets.

UK forecast: The UK’s QSR market is projected to reach a value of $29.7 billion by 2026, from $25.4 billion in 2023. Those figures represent a CAGR of 4.56% between 2021 and 206, and an incremental growth of $2.1 billion.

The UK QSR market will generate growth every year between 2021 and 2026, with year-on-year growth varying between 2.77% and 6.4%.

These figures will make the UK one of the fastest growing QSR markets, and will contribute 5.53% to the global market between 2021 and 2026.

From 4.3% in 2021, the UK will contribute 4.5% to the global QSR market by 2026.

Key quick-service payment trends

Three key trends are impacting QSR payments:

More locations: following the challenges of the pandemic, there has been a 3% increase in QSR restaurants opening in Europe in the past 12 months – which has, in turn, increased payment opportunities.

Healthy food: demand for healthy food at QSRs has increased, putting a premium on service and pushing up prices.

App orders: a significant increase in the use of food delivery apps, and in QSRs own pre-order apps, has contributed to a 'faster food' culture – which has created new integration opportunities, often with fees that can be passed on to customers.

Pubs, bars and clubs

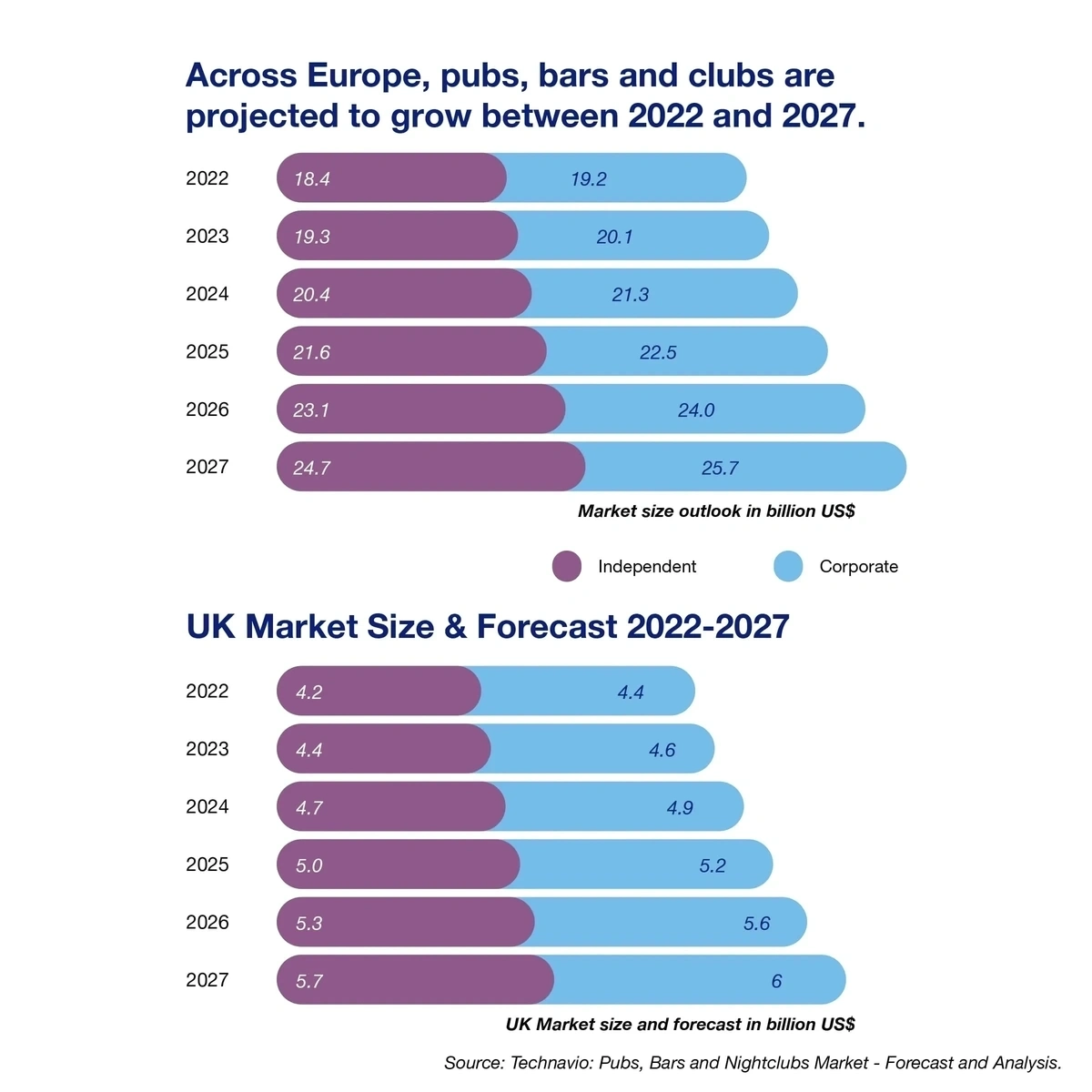

Like other European hospitality sectors, pubs, bars and clubs will grow steadily in the coming years. By 2027, the sector is expected to grow to a value of $50.4 billion, from $39.4 billion in 2023.26 In that same period, the sector’s CAGR is projected to be 6.05%, with incremental growth of $6.5 billion.

Regional growth: Europe’s share of the global pubs, bars and clubs market directly reflects the number of chains in the region, and the relatively high level of consumer spend on leisure activities.

The UK, France, Germany, Belgium, Romania and Poland represent some of the continent’s key alcohol-consuming countries, with the off-trade consumption of beer currently surpassing on-trade. While stable economic growth and a rise in disposable income will contribute to the increasing size of the European market, the home drinking and takeaway services may impact revenues during the forecast period.

Increased revenues: corporate pubs showed 6% revenue growth between 2015 and 2021, rising from 45% to 51%. Revenue share for other types of pub ownership also changed in that time:

Independent pubs increased their revenue share from 34% to 35%.

Tenanted and leased pubs saw a fall in revenue share from 21% to 13%.

UK market outlook: from 2022 to 2027, the value of the UK’s pubs, bars and clubs market is projected to grow from $8.6 billion to $11.7 billion. That increase represents a CAGR of 6.55% and an incremental growth of $1.6 billion (representing 10.14% of the global market).

In 2022, the UK was the third-largest country in the pubs, bars and clubs market and is projected to remain so in 2027. The UK's year-on-year growth will vary from 5.5% and 7.52% during that period.

Key pubs, bars and clubs payment trends

Three key trends are impacting payments in the pubs, bars and clubs sector:

Premium products: a growing demand for premium beverages, including craft beers and spirits, is pushing prices up across the sector and increasing per-unit spend.

Mergers and acquisitions: an industry-wide rise in mergers and acquisitions has seen larger companies purchasing smaller pubs, bars and other establishments. The trend is contributing to an increase in the number of ideal payment customers: Greene King Pubs, for example, has a goal to expand by 50%, with acquisitions a key driver of its strategy.

Winners and losers: although the industry is expected to grow, rising costs will likely tighten margins, hitting underperforming pubs harder (and even leading to closures) while large corporate establishments will be able to deal with the pressure more effectively. With that challenge in mind, the insight and expertise that Elavon provides will be critical to protecting revenue – and potentially make the difference between success and failure.

Payments opportunities for businesses in the hospitality industry

Post-pandemic, hospitality businesses must seize every opportunity they can to boost revenue, especially as the market continues to grow and competitors find ways to distinguish their offerings. Let’s examine some of the specific payments opportunities to emerge from our hospitality trend analysis:

Personalisation

“Elavon gives you the opportunity to customise your terminal – you can add apps tailored to fit your business, add different categories and identify your busiest times of day and best sellers. In one system, you can do everything.”

Strong customer experiences represent a valuable opportunity for hospitality businesses – especially hotels – to grow market share. Loyalty programmes, in particular, are a popular way of making hospitality experiences personal for customers and can be easily integrated into payments contexts. So how should businesses use personalisation as a means to create payments opportunities?

More ways to pay: first and foremost, hospitality businesses can personalise customer experiences by increasing the number of available payment methods, which might include integrating:

Open banking and payments via application programming interfaces (API)

Digital wallets

Mobile phone one-tap card payments

Virtual world payments, for example, in the metaverse.

Prioritising customers: business owners should ask: what do customers want from their hospitality experience? Typically, the answer involves convenience, comfort and value – which means that businesses must find simple technology solutions that can be integrated into apps and other payment contexts, and which encourage loyalty and repeat visits.

Personalisation software: there are a number of useful software tools that hospitality businesses can use to enhance customer experiences. These include, for example, apps that capture data on user spending data, or monitor guest preferences and behaviour.

Positive experiences: by simply getting the fundamentals of customer service right, hospitality businesses can help to deliver memorable, personalised experiences for guests and encourage higher margin spending.

Data and insights

“We use Elavon Connect and we find that to be an excellent reporting tool. It gives us confidence to ensure all our transactions are secure and we have next-day payment, which is fantastic for cashflow. It gives us a single view of all our sites."

In a time of rising costs and inflation, hospitality businesses can draw on data and insights from the market to gain a competitive edge.

Customer spending: hospitality businesses should explore ways to use the data that customers give them when they stay or use their services. In practice, this means putting the infrastructure and human expertise in place to collect and analyse that data.

New technology: hospitality firms can harness customer data by integrating new technology. Certain software, for example, enables restaurants to run in-market testing on kiosks and then analyse that data online. Similarly, food-service establishments may implement in-house delivery solutions that capture customer preferences in order to optimise service.

Researchers and advisors: while new technology generates a wealth of useful data, it can be challenging to extract meaningful insight from that data – especially when teams are busy running a business. With that in mind, it can be advantageous for hospitality businesses (especially independent or mid-corporate establishments) to hire researchers to interpret customer data, and provide insights that focus on increasing profitability. Many industry experts offer services as independent advisors, which businesses can leverage to support the integration of new technologies, or as they open new sales channels.

Speed of service

Serving guests faster is a fundamental way to ensure more positive customer experiences and free staff time to keep on top of wider tasks.

New technologies: as with data and analytics, there are a plethora of new technologies available to help hospitality businesses facilitate faster service – including pay-at-table solutions that integrate into point-of-sale (POS) and digital wallets. Shift-management systems also help business owners to coordinate employee time better and can be integrated into existing POS systems.

Speedy onboarding: the easier it is for businesses to hire and manage new employees, the easier it is to manage increasing customer demand. With that in mind, businesses should seek to integrate full spectrum management software that facilitates speedy employee onboarding (and other critical employment processes).

Reduced staff levels: as staffing shortages persist, hospitality businesses need to develop strategies for dealing with reduced staff levels. New hiring initiatives and adjustments to shift patterns may present solutions, but businesses should really seek to leverage technology wherever possible to automate manual processes and ease pressure. Staffing shortages are a significant challenge for the hospitality industry. Technology solutions that help speed up ordering and payment are no longer simply ‘nice to have’, but essential.

Cost reduction

As inflation puts pressure on products and services, hospitality businesses should seek ways to cut costs without sacrificing customer experiences. Fortunately, there are opportunities to reduce costs through payments.

Service fees: businesses should focus on streamlining resource-intensive processes, such as regulatory checks and reconciliations, as a way to prioritise cost savings over service fees.

Tiered pricing: given the projected revenue rise across the UK and Europe, hospitality businesses are in a position to consider tiered pricing strategies. In practice, this means exploring opportunities to reduce fees on a percentage basis for customers with a higher total spend.

Grow your business with an Elavon EPOS system

Electronic point-of-sale (EPOS) systems can help your business seize payment opportunities and supercharge revenue streams. From out of the box, service-ready systems to bespoke solutions, Elavon’s cutting-edge EPOS technology will save you time and resources, and help you give your customers the experiences they want.

Spotlight on upcoming payments technology

To capitalise on payments trends, businesses must continually be looking ahead. Here are some of the most interesting US/Canada-based payments technologies that are shaping and influencing the global hospitality industry.

|

Sunday |

POPid |

Reef |

|---|---|---|

|

A software-as-a-service (SAAS) payment platform, Sunday enables customers to order without leaving their table, and access the business’ POS to pay online. Added features include bill splitting and tip options.

|

POPid is a facial recognition payment technology designed to increase service speed, track customer journeys and loyalty, and perform data analysis. It can also be integrated into check-in and booking processes.

|

Reef allows businesses to offer food to their customers – even if they don’t have a kitchen – by offering seamlessly-integrated kiosks, and in-room QR menus for neighbouring restaurants.

|

Sunday

A software-as-a-service (SAAS) payment platform, Sunday enables customers to order without leaving their table, and access the business’ POS to pay online. Added features include bill splitting and tip options.

POPid

POPid is a facial recognition payment technology designed to increase service speed, track customer journeys and loyalty, and perform data analysis. It can also be integrated into check-in and booking processes.

Reef

Reef allows businesses to offer food to their customers – even if they don’t have a kitchen – by offering seamlessly-integrated kiosks, and in-room QR menus for neighbouring restaurants.

|

OLO |

7 Shifts |

Omnevo |

|---|---|---|

|

OLO is a personalisation app that tracks guests’ behaviours and spending from a single account, delivering both labour efficiencies, and valuable marketing and loyalty opportunities.

|

7 Shifts is restaurant management software that integrates with POS systems, and offers tools for hiring and onboarding, training, scheduling, and payroll processing.

|

Omnevo enables airlines to deliver seamless experiences to their passengers through a fully integrated platform with easy onboarding of all suppliers and partners creating a single source of data.

|

OLO

OLO is a personalisation app that tracks guests’ behaviours and spending from a single account, delivering both labour efficiencies, and valuable marketing and loyalty opportunities.

7 Shifts

7 Shifts is restaurant management software that integrates with POS systems, and offers tools for hiring and onboarding, training, scheduling, and payroll processing.

Omnevo

Omnevo enables airlines to deliver seamless experiences to their passengers through a fully integrated platform with easy onboarding of all suppliers and partners creating a single source of data.

Building on growth

It’s critical that the hospitality industry maintains a laser focus on post-pandemic growth, which means both identifying commercial opportunities and avoiding pitfalls. The challenge will require business owners to think carefully about how they move forward, but also to find new, innovative ways to coordinate with partners – especially payment providers – in order to boost revenue and attract new customers.

Staff shortages and rising inflation are putting pressure on businesses to reduce costs wherever possible. To address that problem, business owners should embrace technologies that automate manual tasks, streamline operations, improve the speed of service and provide long-term cost savings. At the same time, it will be up to payments partners to reinforce these longer-term cost savings, shift attention away from service fees and explore tiered pricing opportunities to support businesses as they grow.

Following the Covid-19 crisis, and in the midst of rising costs, customers are also expecting more from their brand experiences. In order to meet that expectation, businesses must find new ways to harness data and insight – both to bring greater personalisation to their offerings and to enhance customer experiences. Meanwhile, payments partners should focus on the insights to be gained from payments systems and on the potential for integration with personalisation software. Partners may also be able to provide greater advisor support on new technologies and share whitepapers and wider industry insight.

Despite the adversity of the Covid years, the hospitality industry (hotels, seated, dining, quick service and pubs, bars and clubs) can look forward to impressive forecasted growth – which should be a huge cause for optimism. It’s clear that technology will be a key driver of that growth: from centralising tasks and cutting costs to improving personalisation, hospitality businesses must embrace new technologies to not only remain competitive, but also to tap into massive growth potential. Payments partners will play a key role in that process – by advising on solutions and helping to implement them quickly, and by providing insights and long-term cost savings that help drive revenue well into the future.

Sources

1. https://view.publitas.com/ukh/restarting-hospitality-2021/page/1

2. https://lichfields.uk/blog/2022/nov/30/uk-hotels-market-after-covid-19-an-uneven-recovery

3. https://www.hospitality-net.org/news/4113848.html

4. https://www.technavio.com/report/pubs-bars-and-nightclubs-market-industry-analysis

6. https://www.restaurant-online.co.uk/Article/2023/06/05/uk-eating-out-market-poised-for-4.6-value-growth-in-2023-according-to-lumina-intelligence-data

10. https://www.bbc.co.uk/news/business-64152695

11. https://travel-weekly.co.uk/news/air/cost-of-living-to-impact-almost-half-of-peoples-holiday-plans

13. https://www.distill-ventures.com/insights-and-trends/no-low-consumers-understanding-the-opportunity

14. https://blog.hubspot.com/service/stateof-service-report

16. https://www.statista.com/outlook/mmo/travel-tourism/hotels/worldwide

17. https://www.statista.com/outlook/mmo/travel-tourism/hotels/worldwide

18. https://www.statista.com/outlook/mmo/travel-tourism/hotels/united-kingdom

19. https://www.statista.com/stats/287133/annual-number-of-overseas-visits-to-the-united-kingdom-uk

20. https://www.statista.com/outlook/mmo/travel-tourism/hotels/germany

21. https://www.statista.com/outlook/mmo/travel-tourism/hotels/europe

22. https://www.statista.com/forecasts/516575/in-the-hotels-market-in-the-united-kingdom

23. https://www.future-market-insights.com/reports/food-service-industry

24. https://www.technavio.com/report/dining-out-market-industry-analysis

25. https://www.technavio.com/report/quick-service-restaurants-market-industry-analysis

26. https://www.technavio.com/report/pubs-bars-and-nightclubs-market-industry-analysis