If you process telephone orders and you would like to process these transactions outside of MyOpayo you will need to use the account type field so we know which merchant number to use on your account.

Any telephone transactions processed using your Opayo payment pages that do not use the account type field will refer to your ecommerce merchant number and will present you with the shoppers experience including 3-D Secure.

Search our help centre

Setting up an account

Customer Centre

Different account types

The Opayo platform has the ability to utilise three different types of online payments, ecommerce, where the customer is online and entering their own card details, Mail Order Telephone Order also known as MOTO, where the company enters the card details on behalf of the card holder, and continuous authority, which is used for repeating and subscription style payments.

For vendors who are using the Opayo server method of integration, you are able to process telephone orders without accessing MyOpayo – by using the Opayo payment pages.

The technical bit...

When a transaction is processed using a server there are a number of fields that are sent from your website to ours.

One of these fields is account type.

The account type field can contain 3 values:

- E – for ecommerce transactions

- M – for telephone (MOTO) transactions

- C – for repeat transactions

The account type field is used to simply instruct Opayo which merchant number is going to be used to process the transaction.

Important – In order to send a value as M or C you must have the relevant merchant number active on your Opayo account.

In order to determine the type of transaction that is being processed you will need to include the account type field in your transaction registration post that is sent to us from your website/backend office system.

You can find out all of the information about the transaction registration post in the server protocol and integration guides on our website.

Alongside this you will also need to include all of the customer's details who will be processing the transaction – in order to do this you will need to build a form into your platform that will allow you to capture the customer's details prior to processing the transactions.

How you do this is entirely up to you, however. All Opayo requires is the details of the customer along with the account type field to be submitted to begin processing the transaction.

Processing the transaction

Now that you have included the account type field into your transaction registration post the payment will be able to be processed.

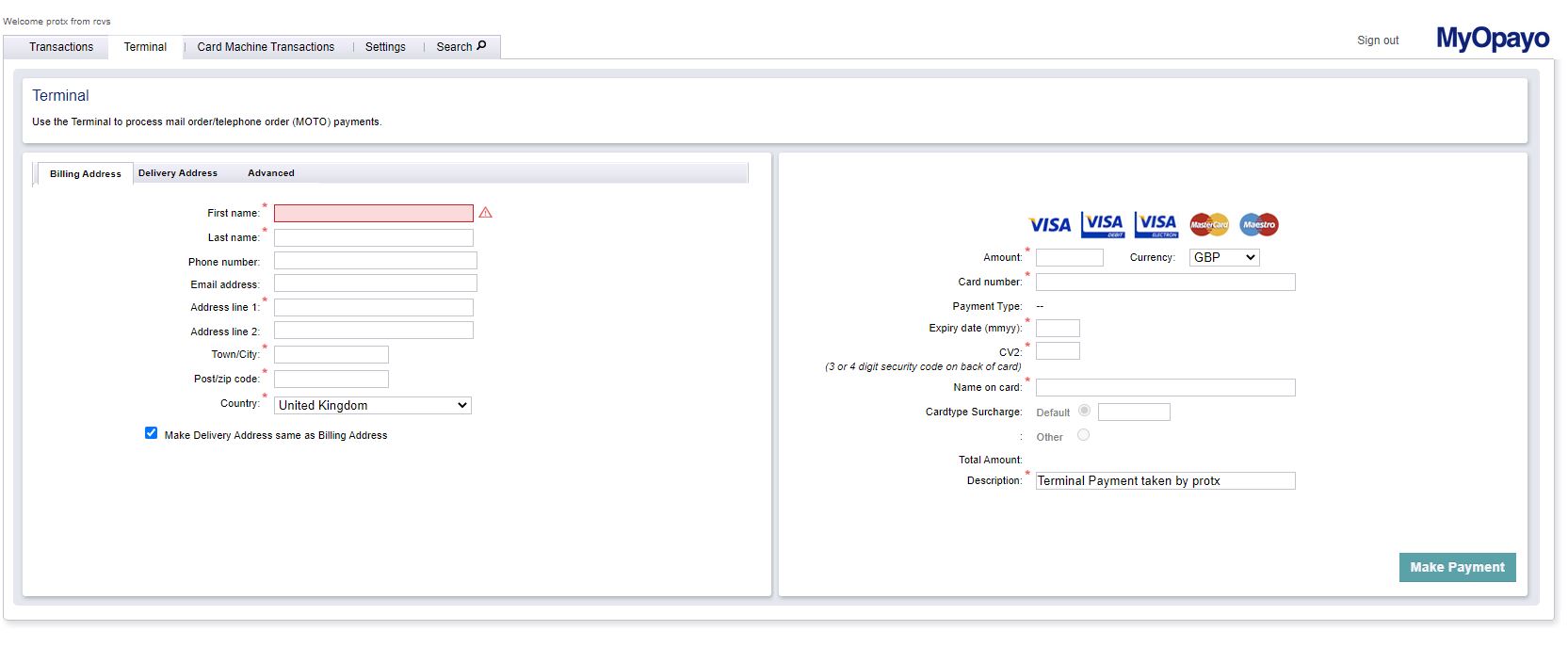

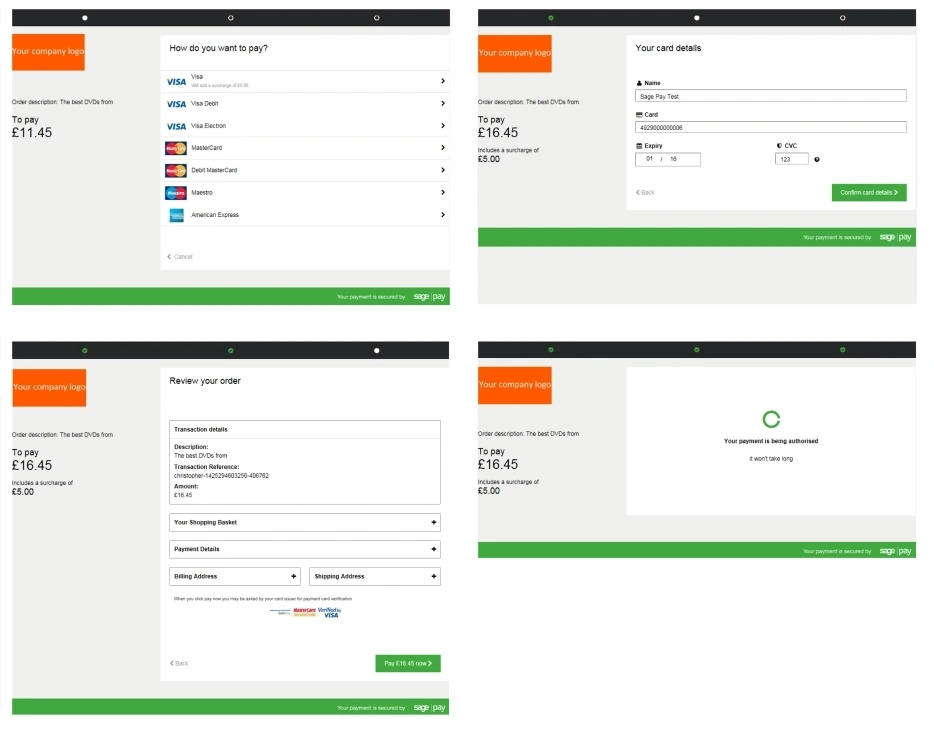

The difference between an ecommerce and MOTO transaction is that you or your staff will be entering the card details for the transaction on behalf of your customer. The customer will provide their card details to your over the phone.

As such you or your staff will be using the Opayo payment pages in place of your customer.

What will happen

If you are using a back-end office platform you will need to ensure the platform can support a post to the Opayo system and either re-direct to a browser (normal server) or support a browser window within the platform itself (server iframe).

For a normal server, you will see the card selection, card details, card confirmation, and authorisation pages when entering the details for your customer.

Integrating the iframe into the platform will have to be done by either yourselves of the platform provider – Opayo provide you with the url that is used for the payment pages but do not integrate this with any software.

That must be written in order to work with our system effectively.

Once the transaction has completed the results and status will be passed back through to your system that can in turn be built into your office platform.

If you are using the Opayo direct method of integration the implementation of telephone orders is completely by yourselves.

You will still need to provide us with the account type field in the transaction registration post but you will also provide us with the card details for the transaction.

As you are using direct integration the capture of the credit and debit card details is done on your own system. Because of this you are able to simply build a form into your backend system that will capture the customer and order details – including the card and simply send them to us to process.

Again, you can do this in the same way as you would with server:

Alternatively you can implement a Pay Now feature to your customers records that will automatically submit the customers and order details through to Opayo when selected – this way you will not need to continually capture customer details at the point of payment.

We will process the order and return the results and status back to you to feed into your platform.

Card types & merchant numbers

Each merchant account that is issued can differ in the cards that are accepted.

Once issued with your merchant account you will be advised to which cards are accepted through your merchant number, and in turn what you are able to have active on your Opayo account.

We currently support the following cards:’ needs to be followed by the list ‘VISA, Visa Delta, Visa Debit, MasterCard (Credit), MasterCard Debit, Maestro, American Express, Diners Club and JCB

Each of the card types that you are able to accept is determined by the agreement you have in place with your merchant bank.

Depending on the currency, and bank you will be able to accept a set amount of card types.

Card Types that are accepted on most GBP merchant numbers as standard are Visa, Visa Debit/Delta, Visa Electron, MasterCard (Credit), MasterCard Debit and Maestro.

These cards are available on your account once set-up and will allow you to process transactions without issue.

Some cards that can be accepted through our systems will require you to obtain a specific merchant number to accept.

- American Express

- Diners

- JCB

Depending on your merchant service you may need an addition Merchant account to accept these card types.

Some cards are only available when you are accepting a specific currency.

The card type UK Maestro can only be accepted in GBP as it is a UK regional card.

If you are accepting multi-currency we always advise speaking with your merchant bank to clarify which cards can be accepted on your account.

Continuous authority

Continuous authority transactions are processed through our system as repeat payments.

If your business uses repeat billing, subscriptions, or you have customers who regularly buy from your business, continuous authority allows you to take another payment without having to re-capture the details.

In order to use continuous authority you must first take a standard payment from your shopper. This will include the capture of the card security code (CV2) and the expiry date.

Once this payment has been processed successfully you are able to perform a repeat against the transaction.

The amount of the original payment does not matter when you are performing a repeat. You are able to repeat the transaction for any amount below or above the previous payment or repeat.

A merchant category code is a 4 digit number that is assigned to a business by card companies.

The code is used to classify the business by the type of goods or services it provides.

Merchant category code 6012 is for businesses who are classified as financial institutions.

If your business falls into this sector you will be classified as MCC 6012 and required to submit additional information with your transactions.

If your business is MCC 6012 you will need to provide additional fields when processing a transaction through your account.

These fields must be included in your transaction registration post – the first contact with Opayo for any transaction.

The fields are:

- FIRecipientAcctNumber

- FIRecipientSurname

- FIRecipientPostcode

- FIRecipientDoB

You can find all of the information you need about the fields in our protocol and Integration guidelines.

An ecommerce merchant number is needed if you would like to trade online. Ecommerce is for sales that are processed through your website.

You will be able to use the Opayo hosted payment pages, or your own custom built payment pages to process credit and debit cards.

Mail order telephone order or MOTO as it is otherwise known is for transactions that are exclusively processed via telephone, or mail order purchases.

Although these transactions can be taken online they are processed differently to ecommerce transactions. Because of this merchant banks will bill differently to ecommerce merchant numbers.

Most merchant banks will require you to obtain both an ecommerce and mail order, telephone order merchant number if you wish to process both types of transactions. Some banks however do allow both ecommerce and MOTO services to be processed through the same merchant number.

Continuous authority merchant numbers is for you to use with recurring payments.

What do I need?

Before you can start using our services you will need to ensure your business has everything in place that is needed to process transactions.

If you do not have all of the requirements you will not be able to link your shopping cart/payment program/Pay-by-link software to.

Once you have everything in place you will then be able to link your software with your Opayo account.

A merchant number is required for you to be able to process transactions through your Opayo account.

Without a merchant number you will actually not be able to accept any transactions.

If you do not have a merchant account we can help you with that. Have a look at our merchant account services page for all of the information you need about the service we can provide to you.

The Opayo gateway has integrations that allow your Web shop, payment system or accounts software, to connect and request payments. Your software provider will be able to confirm how to do this and provide support to integrate with Opayo.

After you have your software, you can apply for a merchant account from Elavon or obtain your own merchant service. At this point you can apply for an Opayo account and if needed an Elavon merchant at the same time.

To apply for an Opayo account all you will need to do is call our sales team on 0800 047 3342 who will be able to help you get your application started.

We will be able to help you with your merchant account along with getting yourself an Opayo account.

Merchant banks & Opayo

When applying for an account with us you must obtain a merchant number in order for your account to work.

We are approved to work with a number of merchant banks and before you can accept payments through your website or over the telephone you will need to set up your merchant account.

Alongside our merchant account services we are also able to support merchant numbers from –

A merchant number is required for you to be able to process transactions through your Opayo account.

Without a merchant number you will actually not be able to accept any transactions.

If you do not have a merchant account we can help you with that. Have a look at our merchant account services page for all of the information you need about the service we can provide to you.

Please click on the bank you would like to obtain the contact information for to be taken straight to their details.

|

Website |

Contact Telephone Number |

|---|---|

|

Call our Sales team on : 0345 850 0195 |

|

|

www.streamline.com |

0800 010 166 |

|

0870 901 7915 |

|

|

08457 585 150 |

|

|

0800 61 61 61 |

|

|

0800 028 0116 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

028 902 75977 (Northern Ireland) |

|

|

www.firstdatams.co.uk |

0800 652 5808 |

Website

Contact Telephone Number

Call our Sales team on : 0345 850 0195

www.streamline.com

0800 010 166

0870 901 7915

08457 585 150

0800 61 61 61

0800 028 0116

N/A

028 902 75977 (Northern Ireland)

01 608 5432 (Rep of Ireland)

www.firstdatams.co.uk

0800 652 5808

Elavon Terms of Service UK

Domestic and Multinational Customers

UK Operating Guide

The point-of-sale procedures

Opayo Merchant Terms & Conditions

(Opayo gateway only)